Following the Prime Minister’s announcement last month that notice to leave the EU under Article 50 will be given by the end of March 2017, the High Court held that the government does not have power to do this under the Royal Prerogative. It therefore seems that an Act of Parliament will be required, although the government has no plans to introduce a bill before the Supreme Court rules on the appeal, which is due to be heard between 5 and 8 December, with judgment expected in the New Year. The High Court of Justice in Northern Ireland dismissed a challenge to the government’s power to trigger Article 50 based on the Northern Ireland Act 1998. Both cases are considered in the Public Sector Blog post, Article 50 and Brexit in the High Court: the immediate aftermath of Miller and Santos and McCord, and further developments. For more information on Brexit and employment rights, see What to expect in employment law: Brexit.

The European Court of Justice has upheld an upper age limit of 35 on applicants to a police and emergency services academy as being a genuine occupational requirement under the Equal Treatment framework Directive.

The Court of Appeal in Northern Ireland upheld the “gay cake” decision on appeal, holding that a bakery had directly discriminated against a gay customer on the grounds of sexual orientation (but not his sexual orientation) by refusing to bake a cake with the caption “Support Gay Marriage”.

The EAT held that District Judges are not workers and therefore not entitled to whistleblower protection. A tribunal was not entitled to consider a hypothetical warning in an unfair dismissal case, where the actual final written warning was manifestly inappropriate. Furthermore, the right to a rest break under the WTR can be infringed even without an explicit request or refusal.

In other big news this month an employment tribunal held that Uber drivers are workers under the Working Time Regulations 1998, National Minimum Wage Act 1998, and ERA 1996. The judgment will be of significant interest to practitioners advising putative workers and employers in the gig economy. Following this case, the Independent Workers Union of Great Britain (IWGB) has threatened legal action against Deliveroo if it refuses their riders’ requests for union recognition and employment rights.

The government has finally responded to the Justice Committee review of courts and tribunal fees, published in June 2016. The MoJ declined to respond to the Committee’s recommendations on employment tribunal fees at this stage as it is finalising the post-implementation review of tribunal fees, which will be published “in due course”. Unison’s judicial review challenge against the introduction of tribunal fees is now due to be heard by the Supreme Court on 27 and 28 March 2017. It seems highly unlikely that any serious progress will be made in considering the Justice Committee’s recommendations until judgment is handed down.

The government also announced new protection for whistleblowers applying for jobs in the children’s social care sector, which will be included in the Children and Social Work Bill 2016-17. HMRC published a consultation on draft regulations to prevent employers of illegal workers from claiming NICs employment allowance for a year and BEIS launched an independent review into electronic balloting for trade unions under section 4 of the Trade Union Act 2016. The final report will be published by the end of 2017. The Lord Chancellor has announced plans to diversify the judiciary, business leaders have proposed London-only work visas, and plans for a new online database for future employment tribunal decisions have been confirmed, sparking fears that the database may be used for employment vetting. Acas has published guidance on marriage and civil partnership discrimination in the workplace.

In disability-related news, the National Autistic Society published a report calling on employers to curb an autism employment gap, Macmillan published research showing one in five people diagnosed with cancer suffer discrimination at work, and the Department of Health has launched a consultation on work, health and disability.

Finally, in the Autumn statement announced on 23 November, the government has decided to remove the tax relief associated with employee shareholder status with effect from 1 December 2016, and, from April 2017, to restrict tax relief to certain benefits, including pension and childcare benefits, provided under a salary sacrifice scheme.

In our blog, Fiona Martin examines the case for employers’s contributions to an employee’s legal costs in a COT3, Jasmine van Loggerenberg questions the effectiveness of the Equality Act 2010 in tackling gender, pregnancy and maternity discrimination in the workplace and Daniel Northall asks whether Judicial assessments are simply the emperor’s new clothes

Next month

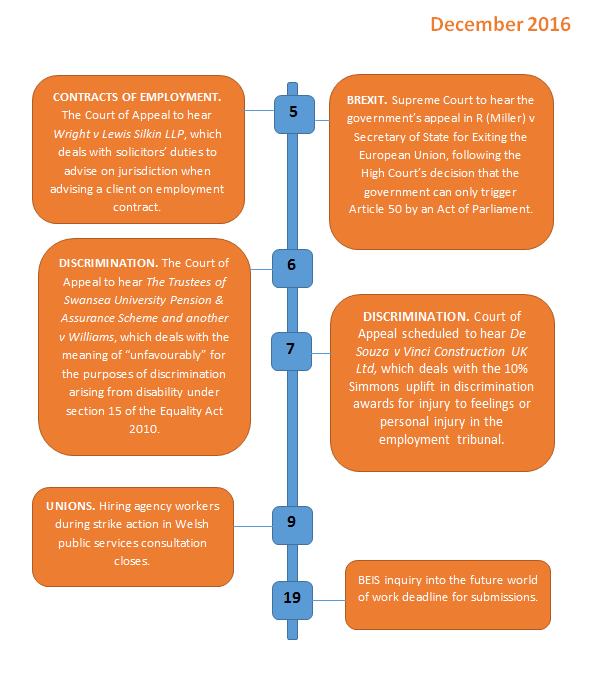

Key developments to look out for in December 2016.

For recent and forthcoming developments, don’t forget What to expect in employment law, Case tracker and Legislation tracker.